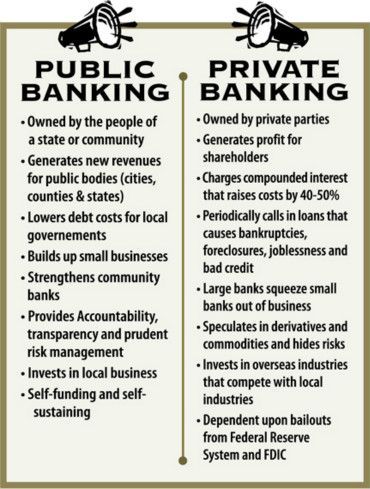

Private banks, both local and national, mostly benefit their shareholders. Publicly owned banks operate for the benefit of the public, and do so with far greater transparency and community input.

Private banks, both local and national, mostly benefit their shareholders. Publicly owned banks operate for the benefit of the public, and do so with far greater transparency and community input.

Credit unions typically operate as non-profits that are more accountable to their members than conventional banks, but Marc Armstrong, Executive Director of the Public Banking Institute, says they are limited in what they can do.

Credit unions typically operate as non-profits that are more accountable to their members than conventional banks, but Marc Armstrong, Executive Director of the Public Banking Institute, says they are limited in what they can do.

Marc ArmstrongOne of the most important aspects of a public bank, explains Armstrong, is the opportunity it affords for interested local citizens to observe and even participate in key business decision-making.

Marc ArmstrongOne of the most important aspects of a public bank, explains Armstrong, is the opportunity it affords for interested local citizens to observe and even participate in key business decision-making.

Some may fear that such a process would lead a public bank to make riskier loans or investments. In practice, Armstrong says, just the opposite has proven to be the case for the Bank of North Dakota.

Some may fear that such a process would lead a public bank to make riskier loans or investments. In practice, Armstrong says, just the opposite has proven to be the case for the Bank of North Dakota.

Marc Armstrong will lead a discussion on public banking at the Share Exchange in downtown Santa Rosa on Wednesday evening, May 2, beginning at 6:30 pm.

You can see and hear a previous North Bay Report interview with Public Banking Institute founder Ellen Brown here. It was originally broadcast December 9, 2010.

Live Radio

Live Radio